Around 2 percent of the world’s ultimate energy consumption is currently dedicated to ammonia production, resulting in annual emissions of 450 million metric tons (MMT) of CO2 directly and 170 MMT of CO2 indirectly. As of 2019, ammonia stands as the second-largest chemical commodity globally, with an annual production of 235.34 MMT. Notably, China leads in production with 48.26 MMT, followed by India with 11.04 MMT in the same year. The ammonia market size reached USD 67.01 billion in 2020, and it is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.4 percent from 2021 to 2028, reaching USD 110.93 billion. Over the period from 2000 to 2020, ammonia market prices fluctuated between USD 100 and 600 per ton. However, in 2021, driven by natural gas shortages, global ammonia prices surpassed USD 1,000 per ton.

Globally, 80 percent of the ammonia produced by the industry is utilized in agriculture, primarily as fertilizer, including Urea and DAP. The demand for urea reached 192 MMT in 2020 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 3-4 percent, reaching 226 MMT by 2023. Beyond its traditional use in agriculture, green ammonia is emerging as a new energy storage vector and a fuel for a decarbonized future. Shipping, responsible for 3 percent of Green House Gas emissions and around 9 percent of global emissions associated with the transport sector, relies heavily on global trade, constituting 80-90 percent of total trade. To address and decarbonize these emissions, green ammonia is being recognized as a key alternative fuel. Projections indicate that by 2050, the shipping industry will require a total of 46 million tons (Mt) of green hydrogen (H2), with 73 percent of it earmarked for producing green ammonia, translating to 183 MMT solely for this sector. This highlights the pivotal role that green ammonia could play in mitigating emissions and fostering sustainability within the shipping industry.

Technological Advancements

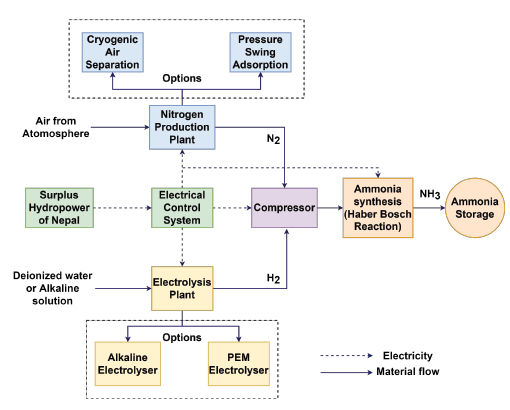

Globally, 90 percent of ammonia is produced by the conventional Haber-Bosch Process, which is fossil fuel-based technology. Recognizing the global need to achieve net zero carbon coals and create a green economy, there is a need and demand to shift of conventional ammonia production technology to renewable technology, as shown in Figure 1. In the Haber-Bosch synthesis coupled with electrolysis for hydrogen production is powered by renewable electricity transformation, other processes remain the same.

The first commercial-scale green ammonia plant was established in 2022 with a capacity of 5000 metric tons per year in Denmark. Asian RE Hub announced a project of 26 GW for ammonia as an export pathway with an investment of USD 36 billion, HEVO Ammonia Morocco Project, which aims to produce 183,000 tons of Green Ammonia by 2026 with an investment of USD 850 million. ACME has announced a USD 6.5 billion green hydrogen and ammonia project in Tamil Nadu. The project will consist of a 5,000-megawatt solar plant, 1.5-gigawatt electrolyzer capacity, and 1.1 MMT of ammonia synthesis loop. Acme group has also signed a land agreement to set up one of the world’s largest green ammonia projects (2400 Ton per day (TPD)) at the Special Economic Zone at Port of Duqm in Oman with approx. investment of USD 3.5 billion. India-based ReNew Power and the General Authority for Suez Canal Economic Zone (SCZONE) have signed an agreement for a new, $8 billion, million-ton-per-year renewable ammonia production plant. Nonangel has signed an agreement with two German engineering firms to build a 280,000-ton-per-year renewable ammonia production plant on the coast just north of Luanda, Angola’s capital.

Only with the use of air (abundant in earth’s atmosphere), water (2.7 percent of the available fresh water on Earth is in Nepal), and hydroelectricity (high hydropower potential i.e., 83,000 MW theoretically and 42,133 MW economically in Nepal), there is a huge possibility of green ammonia production in Nepal. Nepal has a present installed capacity exceeding 3000 MW of hydroelectricity as per the generation reported in 2023. An additional 7000 MW of hydropower projects are under construction, and more than 30,000 MW are in various stages of development. If the construction of these projects is completed as per plan, the country will be able to generate more than 12,000 MW of electricity by 2030. However, the forecasted domestic demand for electricity falls much lower than its production within this year. By the end of 2028, Nepal could have an excess of 3500 MW of electricity that might go to waste if proper energy management and policies are not defined at present.

One alternative to transmitting electric power from one point to another could be through ‘green’ hydrogen and its derivatives. Hydrogen’s high mass-energy density, lightweight, and facile electrochemical conversion allow it to carry energy across geographical regions through pipelines or in the form of liquid fuels like ammonia on freight ships. Across sectors, it can be used as a chemical feedstock, burned for heat, used as a reagent for synthetic fuel production, or converted back to electricity through fuel cells.

Recent developments with green hydrogen in Nepal

Nepal started to make necessary policies by prioritizing green hydrogen-based industrial/commercial projects in Nepal. Two high-level committees were formed by the Ministry of Energy, Water Resources and Irrigation for the draft policies on Green Hydrogen, Green Ammonia, and Chemical fertilizer production in Nepal. Based on the recommendations Nepal government for the first time has included the programs for Green Hydrogen in its national policy and budget for the year 2022/23 with a commitment to establishing chemical fertilizers factories using green hydrogen and green ammonia technology, and initiating commercial use of hydrogen energy to contribute to the overall development of Nepal’s fuel and energy consumption and transport and industrial sectors. The government has initiated the process of approving a “National Policy for Production and End Use of Green Hydrogen”.

The government, through the Nepal Electricity Authority, has initiated a 5 MW Pilot scale Green Hydrogen-based Ammonia production project for contribution to the domestic economy and better utilization of hydropower-generated electricity. It is expected that this project will serve as the foundation for larger projects inviting local and international investments.

Business Model Analysis

To identify a suitable and sustainable business model for the production of green ammonia in Nepal, Green Hydrogen Lab has built a numerical model based on the literature data and the simulation data to compare a variety of green ammonia production scales. From this comparison, one can predict the feasible scale of production with reasonable accuracy.

The design considerations of green ammonia production are with green hydrogen from the electrolysis and nitrogen either from Cryogenic Air Separation (Large Scale 500 TPD N2) or Pressure Swing Adsorption (Small Scale 500 TPD N2). To estimate the reasonable feedstock quantity, energy, and total CAPEX reasonable assumptions are adapted from the literature. From the stoichiometric ratio and the reactor’s overall conversion (97%) in the green Ammonia Synthesis Loop (ASL), the feedstock quantity was calculated. From these data, other parameters such as Electrolyser Capacity, Air Separation Unit (ASU) Capacity, Electrolyser CAPEX, ASU CAPEX, and ASL CAPEX and Energy Requirement were calculated. The production scale varies from 2000 to 3500 TPD single-line ammonia plants at a large industrial scale. Looking for the possibility of a feasible ammonia plant in Nepal, this study includes the production scale from 50 TPD to 5000 TPD.

This study was carried out with the following assumptions:

Plant life: 25 years

Plant working days: 330 days

Efficiency of Electrolyser: 70%

Electricity Tariff Rate: NPR 3 (0.024 USD) per kWh [Subsidized price for this study]

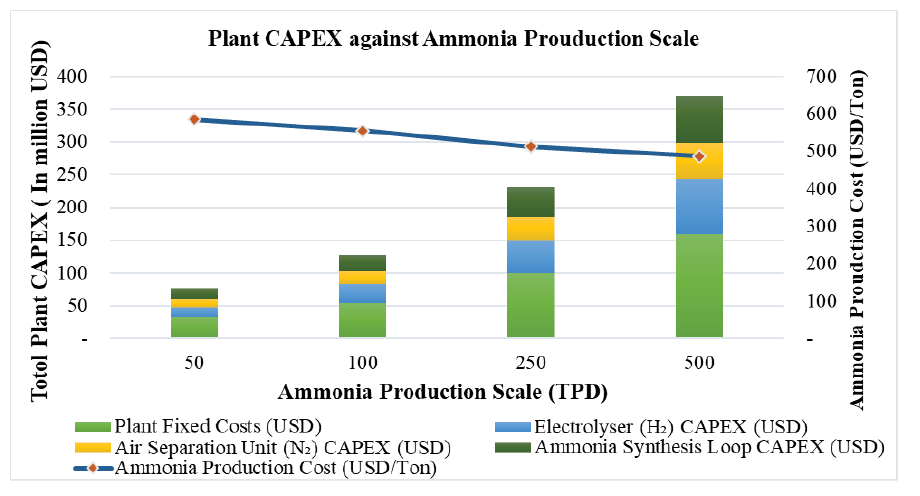

In this study plant with a capacity of 50 TPD to 500 TPD is considered a small-scale plant and above 1000 TPD is considered a large industrial-scale plant. For the small-scale production of 50 TPD, an electrolyzer with a capacity of 22 MW is required. For the medium scale of production size 500 TPD, 215 MW of Electrolyser would be required. The Overall Plant CAPEX (including Fixed Costs) for 50 TPD and 500 TPD is USD 76.61 million and USD 371.71 million respectively as in

Figure 2. From the analysis for plant operation (25 years), the base price of ammonia is around 586.19 USD/ Ton and 487.69 USD/ Ton at a scale of 50 TPD and 500 TPD respectively. This shows the economy of scale and benefits of the larger-scale ammonia production facility.

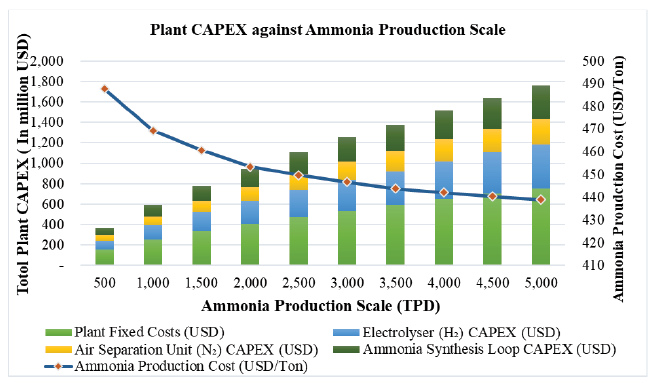

On the large industrial scale of production from 1000 TPD to 5000 TPD, both the CAPEX per unit plant size and the cost of production of Ammonia (USD/Ton) decrease gradually. For the production of 1000 TPD, an electrolyser with a capacity of around 430 MW is required and for the mega-scale of 5000 TPD, 2150 MW of Electrolyser would be needed. The Overall Plant CAPEX (including Fixed, O&M costs) for 1000 TPD and 5000 TPD are USD 593.18 million and USD 1.7 billion respectively as in Figure 3. From the analysis for plant operation (25 years) the base price of ammonia is around 469.47 USD/ Ton and 438.88 USD/ Ton at a scale of 1000 TPD and 5000 TPD respectively. From this study, the profitable scale of production of green ammonia would be 1000 TPD and onwards from the viewpoint of the economy of scale and cost of production of ammonia. Here, initially, the cost of ammonia gradually decreased moving from 50 TPD to 1000 TPD, but after that, the decrement is rather slow. This can be attributed to the slow decrement or nearly constant unit cost of the Electrolyser, ASU, and ASL. The price of ammonia production can be further reduced by selling enormous oxygen (O2) co-products in the Electrolyser and Air Separation Unit.

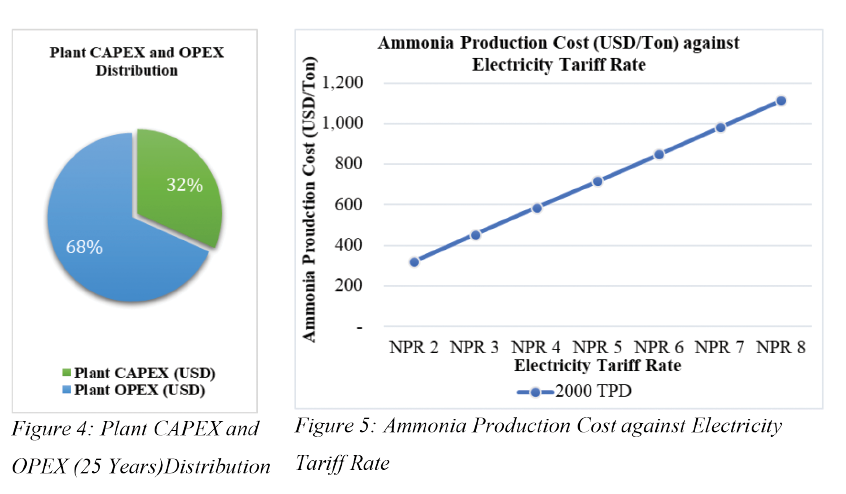

As the analysis period is considered for 25 years, the production cost of ammonia per ton is largely dependent on the OPEX of the plant (Figure 4). The plant OPEX is sensitive to the price of electricity as it contributes to overall expenses. A preliminary sensitive analysis of the production cost per ton with electricity tariff rate (Figure 5) shows that the production cost of Green Ammonia below NPR 7 per kWh of electricity is cost competitive. The price of electricity the hydropower companies in Nepal are receiving from the Nepal Electricity Authority is much below this price, which opens Green Ammonia production as an alternative and more profitable business in Nepal.

Future Directions

Nepal holds significant potential for exporting energy in the form of green ammonia to other countries, leveraging its fast-flowing rivers and growing hydropower production. However, strategies and action plans for establishing proper energy evacuation systems face challenges stemming from political, social, and technical factors, particularly concerning electric energy loss through transmission lines and power grids. Currently, grid-based energy evacuation from Nepal is primarily directed towards India and Bangladesh, despite the country’s substantial potential as a green energy exporter.

A potential solution involves dedicating hydropower resources to green ammonia production. The adoption of DC machines and the elimination of transmission lines could substantially reduce hydropower development costs. Utilizing waterways along major rivers such as Karnali, Bhotekoshi, Budi Gandaki, and Arun could facilitate industrial-scale ammonia evacuation to the Bay of Bengal. From there, Nepal could export green ammonia to the global market. Establishing a strategic partnership with India is crucial to enabling cross-border trade of green ammonia, and enhancing energy security in the region. Nepal, with its renewable energy sources, can ensure a stable supply of green hydrogen-based ammonia. Simultaneously, India can diversify its ammonia sourcing, reducing dependence on traditional coal-based production, and exploring means to export it in the regional and international market. Such collaboration holds the potential to transform the energy landscape and contribute to sustainable development in both countries.

(Thapa is an Associate professor at Kathmandu University head of hydrogen lab)